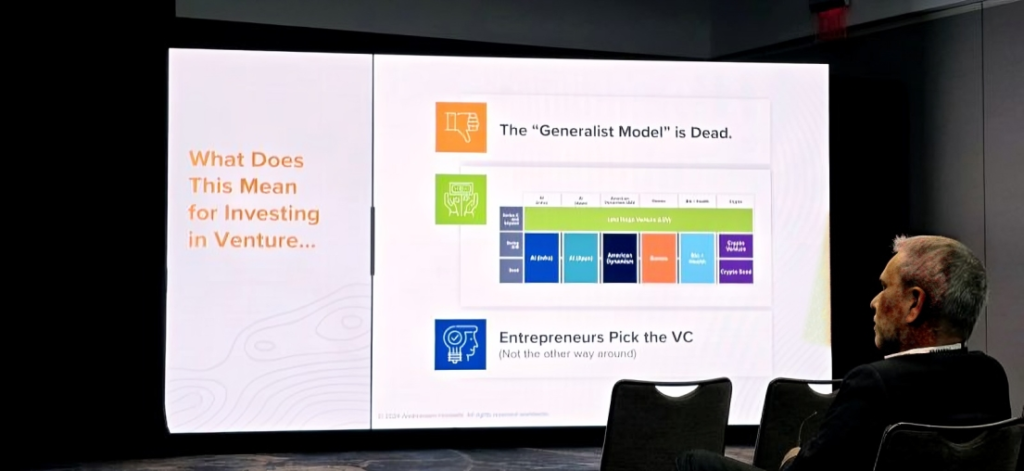

Scott Kupor of Andreessen Horowitz recently captured a pivotal shift in venture capital: “The ‘Generalist Model’ is dead.” Today, founders are looking for more than just capital; they seek investors with the specific expertise and value-add that can help their startups thrive in a competitive landscape.

Andreessen Horowitz (a16z), one of Silicon Valley’s top venture capital firms, is renowned for spotting emerging trends and backing transformative companies. Since its founding in 2009, the VC firm has grown substantially, now managing approximately $55 billion in assets across multiple funds, a testament to its impact and leadership, especially in technology investments.

Kupor’s statement reflects the changing dynamics in venture funding where founders increasingly seek investors who bring specialised expertise and sector-focused insights to the table.

At HealthCap Africa, we stand at the forefront of this change as a specialist fund focused exclusively on early-stage healthtech and fintech startups in Africa. According to a Pitchbook study, specialist funds outperformed generalist funds in terms of internal rate of return (IRR) by 4% over a 20-year period. An analysis by Cambridge Associates and Callan in the last 20 years revealed that 96% of specialist funds have been focused on the fintech and healthtech sectors. Healthtech companies backed by firms with deep expertise were far more likely to record a successful IPO or acquisition than their generalist peers—with exit success rates of 75.5%. Remarkably this trend has translated into a broader acquisition pattern. In the 20-year period, an average of 88% of the total fund count representing buy-out funds have been strategically focused on fintech and healthcare specialist funds, as opposed to 51% interest in generalists.

Our commitment extends from empowering healthtech startups to reduce maternal mortality to supporting fintechs driving financial inclusion. Our industry insights and hands-on approach help founders overcome unique challenges and achieve transformative impact.

Our Impact

HealthCap Africa brings a deep, data-driven understanding of healthcare sciences, the paths of evidence-based medicine, and the operational dynamics of healthcare systems to every investment. This approach has enabled us to make a tangible impact:

- Active in over 10 African countries, creating sustainable, meaningful change.

- Providing enhanced access to healthcare for 2 million patients.

- Generating over 1,000 jobs to support economic growth and prosperity.

- Improving healthcare affordability, accessibility, and acceptability across the continent.

Our Team

Our team combines unmatched clinical and financial expertise. With professionals like a pharmacist advancing her CFA certification and a lab scientist skilled in finance and accounting, we bring a holistic view of healthcare investment that goes beyond numbers. This unique blend of knowledge enables us to drive meaningful change, ensuring our investments deliver both social impact and financial returns.

Join us in reimagining healthcare across Africa. Together, we can build a healthier, more inclusive future for millions.